Contreparties meet each other by the means of the screen and agree on a transaction in videotex mode, where data are loosely structured. The teleprinter, or Teletype, got financial quotes and printed them out on a ticker tape. US equities were identified by a ticker symbol made of one to three letters, followed by the last price, the lowest and the highest, as well as the volume of the day. Broadcasting neared real time, quotes being rarely delayed by more than 15 minutes, but the broker looking for a given security’s price had to read the tape…

Matthew is a junior majoring in Finance with minors on Gender Studies and Computer Information Systems. While not in class, working, or participating in the Bentley Investment group, he uses Python to find arbitrage opportunities in equity and crypto options markets. Christopher is a junior at Bentley University majoring in Finance with a double minor in Computer Information Systems and Law. He is graduating in December 2022 and will be part of Bentley’s Advance Standing in Finance program where he will graduate with his Masters of Finance in May 2023. In the past year, Christopher has interned with Adelphi Capital Partners as a private equity analyst assisting with their acquisition search and their $6 MM add-on acquisition.

Around https://bigbostrade.com/, Miles is a student ambassador for the admissions office, a Portfolio Manager for the Bentley Investment Group, and is on the Executive Board of the Bentley Consulting Group. Leijia is a Master of Science in Finance student at Bentley University and expecting to graduate in December 2021. She was work in American General Life Group for two years and awarded AIG Financial Network Elite honor in 2018. She was an actor in Chinese performing art Club in University of California Riverside and she loves playing guitar during free time.

The ability to quickly access and assimilate current and historical financial data significantly supports quantitative faculty research, while also providing learning opportunities for students who assist in extracting the required information. Further, access to commodity and financial data creates opportunities for interdisciplinary collaborations at the undergraduate and graduate levels. Through team-based and individual study, students gain a greater understanding of how financial markets respond to new information. As students experience the impact of global currency fluctuations, variances in governmental policy, and corporate and individual decision-making, the sense of a “global economy” expands beyond that of a textbook discussion to one that is more attuned with the way 21st century students learn.

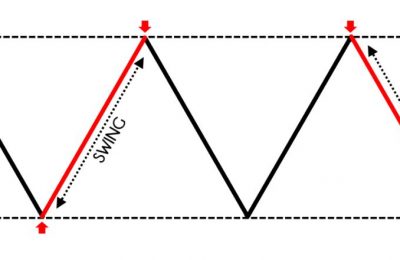

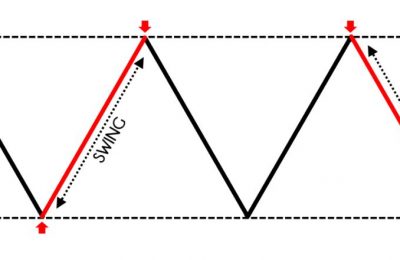

While the Italian-born Telematico finds its place, in the European trading rooms for trading of sovereign-debt. Technical analysis graphically shows a given asset’s behaviour over a long or short period of time, in order to help anticipate the price’s future path. The digital revolution, which started in the late 1980s, was the catalyst that helped meet these expectations. It found expression, inside the dealing room, in the installation of a digital data display system, a kind of local network. Incoming flows converged from different data providers, and these syndicated data were distributed onto traders’ desktops. One calls a feed-handler the server that acquires data from the integrator and transmits them to the local distribution system.

“traders” are in contact with “brokers” – that is, with the above-mentioned investment banks’ “sales”; however, this profile is absent from asset management firms that chose to outsource their trading desk. Some large trading rooms hosts offshore traders, acting on behalf of another entity of the same institution, located in another time-zone. One room in Paris may have traders paid for by the New York City subsidiary, and whose working hours are consequently shifted.

Student Services

This addition to Hood’s academic facilities fulfills the vision of the College’s business administration department to provide a place for students to simulate real-world experiences of working with financial markets through securities trading and portfolio management. The room exposes students to similar technology and analytical tools as used on Wall Street and features trading stations, a stock quote ticker and financial investment software. Funding for this room was secured through a lead gift from alumna Virginia Munson Hammell ‘67 and gifts from Janet Hobbs Cotton ‘59 and her husband John, Susan Edmiston ’87, Robert Hooper, Neal Wilson and Frederick County Bank. In the context of financial markets, a trade room is an office space where buying and selling of financial products is carried out. People working in this trading room, making these sales and purchases, are known as traders.

- A selection of his past employers includes Eurobrokers, ICAP, Tullet-Prebon, Newedge , Societe Generale, Morgan Stanley.

- Typically, a trading room is a loud office space with television screens positioned for traders to hear the latest broadcasts about the financial markets on business channels.

- Watch a pro trader firsthand to see how fundamental concepts and trading methods.

- The unique combination of interactive presentations, delivered by industry leaders, followed by practical simulation reinforces learning whether you want to be a trader or just enhance your knowledge of the oil markets.

Exchanges are where buy and sell orders are actually executed, and they contain a trading room where either live specialists and brokers carry out trades or where electronics are used to facilitate orders. A trading room filled with live specialists is known as an open-outcry system. In this system, traders rely on hand signals to communicate trade details, such as how much of which security to buy or sell, with one another.

NEWSROOM

In the United Kingdom, the Big Bang on the London Stock Exchange, removed the distinction between stockbrokers and stockjobbers, and prompted US investment banks, hitherto deprived of access to the LSE, to set up a trading room in the City of London. The spread of trading rooms in Europe, between 1982 and 1987, has been subsequently fostered by two reforms of the financial markets organization, that were carried out roughly simultaneously in the United Kingdom and France. The Con Edison Trading Room also provides a venue for presentations by industry representatives. Bloomberg and FINRA are among the companies whose representatives have visited the Con Edison Trading Room, where they have shared their work experiences and outlined their student internship and career programs. The trading room at Florida State University’s College of Business is equipped with an 80-inch presentation display, three 55-inch financial data displays, Bloomberg terminals, an eight-zone world clock, 35 touchscreen computers and scrolling stock tickers. The goal of the trading room is to replicate those used by Wall Street investment firms.

The trading rooms were first established in the US in 1971 when the NASDAQ index was created. It was between 1982 and 1987 that trading rooms gained popularity across Europe. Two financial market organisation reforms introduced simultaneously in France and the United Kingdom fostered the growth of trading rooms in the continent. Several new trading opportunities arose, and as a result the need for more traders working together emerged, giving rise to the idea of trading rooms.

College of Business

Trades are either carried out electronically, such as over the computer, or verbally and over the telephone. Typically, a trading room is a loud office space with television screens positioned for traders to hear the latest broadcasts about the financial markets on business channels. When a stock is mentioned on business television, there is usually immediate buying or selling activity in that security, which traders will then try and capitalize on. The terms “dealing room” and “trading floor” are also used, the latter being inspired from that of an open outcry stock exchange.

At the end of the https://forexarticles.net/, I review the setups and describe their strengths and weaknesses, and then take questions. In program trading, orders are generated by a software program instead of being placed by a trader taking a decision. It applies only to organised markets, where transactions do not depend on a negotiation with a given counterparty. Though software alternatives multiplied during this decade, the trading room was suffering from a lack of interoperability and integration. Some institutions, notably those that invested in a rapid development team, choose to blend profiles inside the trading room, where traders, financial engineers and front-office dedicated software developers sit side by side.

The Madden Center for Value Creation is named in recognition of Bartley J. Madden, an independent researcher, author, and expert in the field of investment research and money management. The Center engages with scholarly and student activities, events, and the promotion of value creation for widespread prosperity. Brings together real-time data on every market, breaking news, in-depth research, powerful analytics, communications tools, and world-class execution capabilities in one fully integrated solution. The Flex Trading Room dives deeper to explore how you could thrive by simply adapting those different strategies, different financial instruments, and different environments to your trading style.

This infrastructure is a prerequisite to the further installation, on each desktop, of the software that acquires, displays and graphically analyses these data. From the early 1980s, trading rooms multiplied and took advantage of the spread of micro-computing. Spreadsheets emerged, the products on offer being split between the MS-DOS/Windows/PC world and the Unix world.

As open outcry is gradually replaced by electronic trading, the trading room becomes the only remaining place that is emblematic of the financial market. It is also the likeliest place within the financial institution where the most recent technologies are implemented before being disseminated in its other businesses. Elias is a senior at Bentley University majoring in Finance and pursuing minors in both Computer Information Systems and Data Technologies and the current Trading Room Student Manager. He is part of the Men’s Varsity Soccer Team, VP of Fundamental Research for the Bentley Sustainable Investment Group, a brother of Delta Sigma Pi, as well as a variety of other student groups on campus. Prior to his current role as a Trading Room Student Manager, Elias has had experience in wealth management at Facecapital Advisors, a family office in Miami Florida, managerial accounting at Dufry, and most recently, corporate finance and capital markets advisory at J.P. Morgan as an Investment Banking Summer Analyst vin the Equity Capital Markets team.

The Stillman School is the only business school to have rung the opening and closing bells at the NYSE and the NASDAQ a total of six times. The Trading Room offers a simple yet elegant setting for guests featuring large windows with views of Berkeley Street. The beautiful wood and glass doors along with partial glass wall allow guests to enjoy the energy of the restaurant from the comfort of their own private space at the top of the stairs on the second floor of the restaurant.

Institutional investors, https://forex-world.net/ management companies and portfolio management companies that are involved with the buying side of the business. Opened in 2013, the Frances and Norman Cohen Trading Room and Financial Center gives students access to Morningstar Direct, which provides detailed and historical financial information about stocks, bonds, mutual funds, and commodities. Real-time stock tickers and data boards provide important financial information.

The facility gives students and faculty access to real time information and industry standard tools and applications. The trading rooms at large exchanges might be devoted to a particular asset class, such as equities, bonds, or commodities. Financial transactions are monitored by the regulatory agency for the financial markets in a particular region. Traders often earn fees and compensation based on the number of trades they carry out, and also based on the price for which securities are bought and sold. The trading simulation experience is supported by a powerful bespoke trading platform that features a live trading screen, price charting application, instant messenger, news feeds and a real-time portfolio with profit and loss reporting and exposure tracking.

Trading theories and concepts and trained and put into practice through computer enhanced trading simulations. The course covers oil and gas market fundamentals together with physical and paper trading concepts. The first of its kind at any business school in the London area, with the potential to be able to run a real world experience remotely from our servers in London to reach participants spread worldwide. Provides information on thousands of public and private companies and private equity firms, including company descriptions, business segments size, market performance, summary financial, events, deal history, ownership, private equity holdings, and key executives. The metal-frame Chicago Stock Exchange building was one of Dankmar Adler and Louis H. Sullivan’s most distinctive commercial structures.

Prior to her current role as the Trading Room Assistant Student Manager, Marisa has completed several internships at Loomis, Sayles & Company including within the Alpha Strategies, Technology, and Credit Research Departments. Outside of the Trading Room, she has previously been involved in several organizations such as the Campus Activities Board, the Bentley Association of Chinese Students, and the Student Government Association. “We are concerned with preparing students to develop an executable trading strategy based on analysis of the market, and adaptable to events as they unfold, in a risk-controlled manner.” Located on the fifth floor of Jubilee Hall, the area of the relaunched Center has increased by 50 percent, resulting in 12 dedicated terminal locations and room capacity for 30 students.

Specialized computer labs that simulate trading rooms are known as “trading labs” or “finance labs” in universities and business schools. Harrison is a senior at Bentley University majoring in Computer Information Systems with a double minor in Business Economics and International Affairs. Other involvements of his include induction into the Falcon Society, the Student Government Association, and Senior Class Cabinet.

Recent Comments